3 Energy Markets

Energy sector organization structure

Regulated monopolies

• One or more vertically integrated companies are responsible for generation, transmission, distribution and supply of electricity.

Competitive markets

• Energy industry is vertically unbundled:

– Transmission and distribution of electric power are regulated natural monopolies.

– Generators and suppliers operate in a liberalised market environment.

– Generators compete in the wholesale electricity market to sell electricity to large industrial consumers and suppliers, while suppliers compete in the retail electricity market to sell electricity to the final consumers.

Unlimited access of all the parties to the electric power network is ensured in the principle of access of the third parties to the network – Third Party Access (TPA).

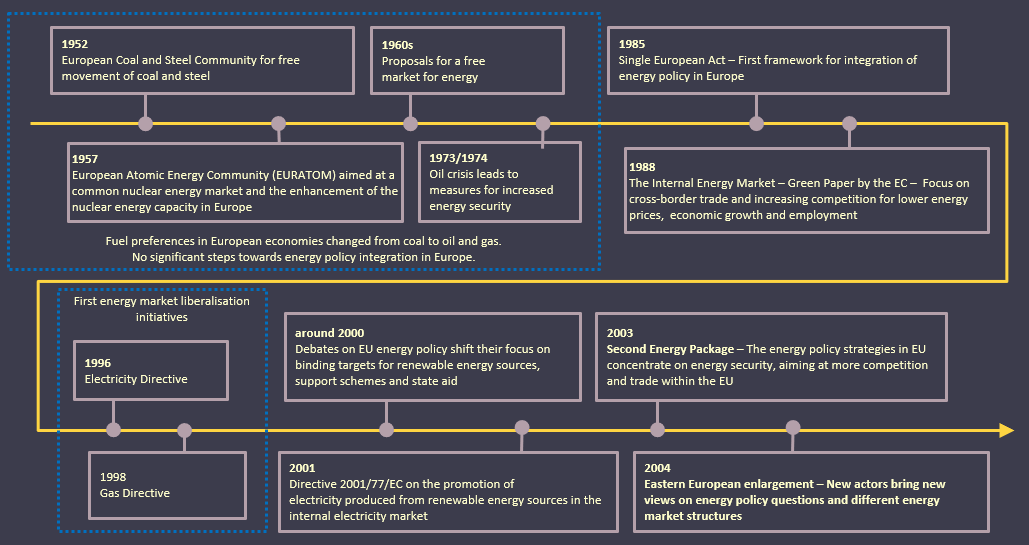

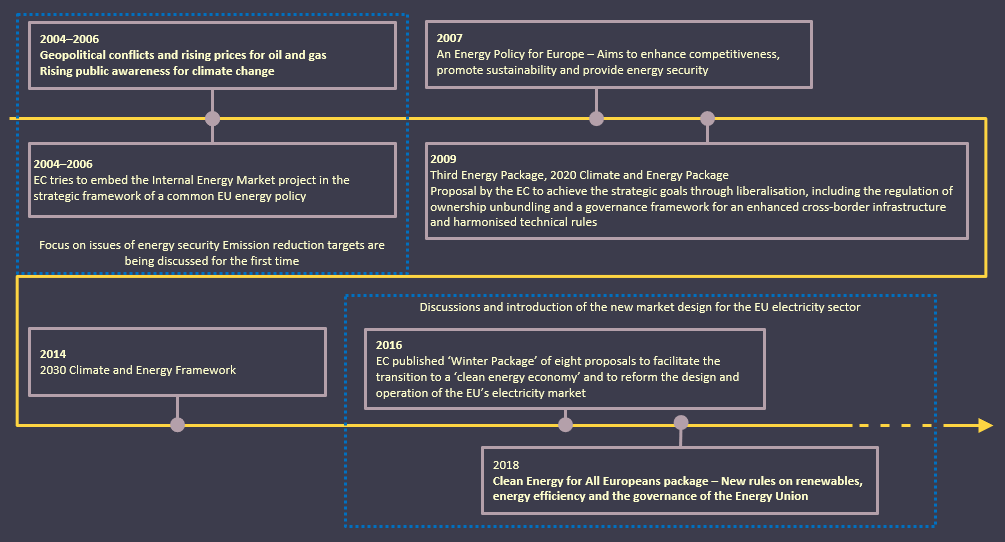

European energy policy timeline

Establishing energy market main goals

Basic goals for composing energy markets are:

• introduction of competitiveness – to increase effectiveness of energy enterprises’ operation, and as an effect minimisation of final customers’ prices,

• ensuring proper incomes for energy enterprises needed for maintenance and development of technical and organizational infrastructure,

• ensuring country’s energy security.

Energy market designs

Energy-only markets

• Generators are remunerated only for electric energy generated and sold to the market (expressed in €/MWh during a specific period)

• Intermittent Renewable Energy Sources affects the energy market – prices for generating electricity may not be high enough in time of peak demand to recover fixed costs of existing power plants, what is potentially endangering future security of supply („missing money problem”)

Capacity markets

• Generators are remunerated also for the generation capacity they have available in the market

Generating companies are not dependent on peak price levels – thay receive an additional revenue stream, valuing the installed capacity of a generation unit, in addition to the existing one for energy.

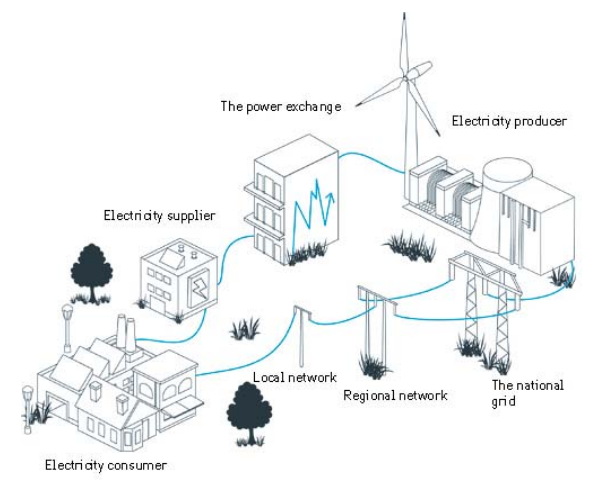

Illustration of the physical transfer of power (bottom part) and the financial transfer (upper part), where power is purchased and sold.

Types of energy markets – trading

• Electricity traded in a dedicated power exchange or multilateral trading platform

• Market participants submit generation and demand bids.

• The market is cleared once per predefined time period and a single market price is determined.

• Power traded in bilateral over-the-counter (OTC) transactions

• Market participants (generators and consumers) agree on a trade contract by directly interacting with each other.

• OTC trading can take the market price published by the power exchange as reference price.

• Organized over-the-counter (OTC) trading

• Market participants submit generation and demand bids to a market platform which is cleared continuously.

• One market player can bilaterally accept the bid of another market player, resulting in different prices for each trade.

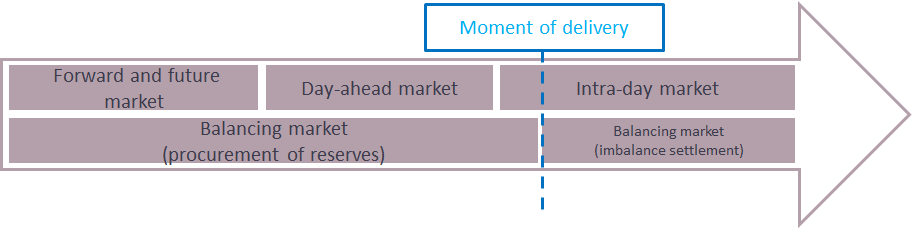

Main parts of electricity market (EOM)

Main parts of electricity market (EOM)

Forward and futures market

• Electricity traded from years before up to the day before delivery

• Contracts to deliver/ consume a certain amount of electricity at a certain time in the future for a agreed price

• Futures are standardized contracts that can be further traded on power exchanges

• Forwards are mainly bilateral OTC, not standarised contracts – they give more flexibility to the involved parties, but cannot be further traded

Day-ahead market

• Electricity traded one day before actual delivery

• At the end of the day-ahead the market zone has to be in balance (balance of scheduled generation, forecasted demand , import and export to other market zones)

• Traded with day-ahead bilaterall OTC contracts or on the day-ahead power exchange

Main parts of electricity market (EOM)

Intra-day market

• Electricity traded on actual delivery day

• Market participants are able to adjust to better wind forecasts, unexpected power plant outages, etc.

• At the end of the intra-day market zone may not be in balance – balance responsible prty will deal with in the balancing market.

Balancing market

• The TSO have to maintain the system balance by activating aviable reserves or demand side management

Balancing market (EOM)

Procurement of reserves

• Reserve market is not energy-only market – both energy and capacity services can be contracted.

• Main types of reserves are:

– Frequency containment reserves (previously “primary reserves”) – used to stabilize the frequency within the time-frame of seconds are controlled automatically and activated locally.

– Frequency restoration reserves (previously “secondary reserves”) – used to restore the system balance within the time-frame of seconds up to 15 minutes and are controlled automatically and activated centrally.

– Replacement reserves (previously “tertiary reserves”) – used to restore the system balance when frequency restoration reserves are not aviable and to allow the FRR units to return to their pre-imbalance status, activated within the time-frame of minutes to hours, controlled manually and activated locally.

Settlement of imbalances

• Imbalance settlement takes place after the phisical delivery.

• BRP buys upward or downward regulation and pays the reserve provider for extra generation or load shedding.

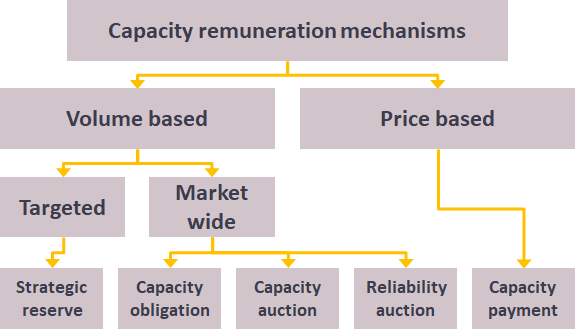

Capacity mechanisms

Capacity mechanisms are administrative measures to ensure the achievement of the desired level of security of supply by remunerating generators for the availability of resources. They are needed to maintain resource adequacy – the ability of the electricity system to offer sufficient generation and flexibility to ensure reliable electricity supply at all times.